Complaince and Reglatory Projects

The FCA’s new regulations demand a proactive approach to operational resilience, requiring firms to not only react to disruptions but also prevent, adapt, recover, and learn from them. Are you ready for the transition?

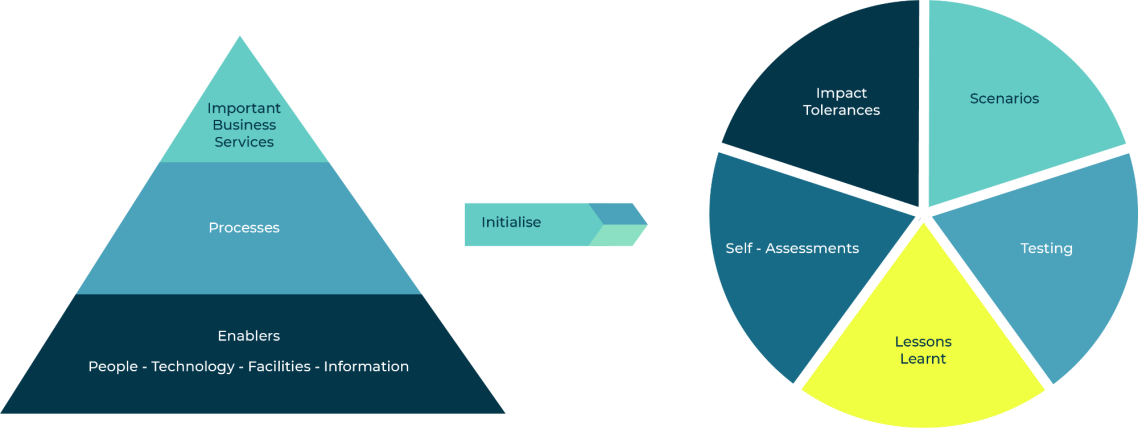

Our expert team provided our client with comprehensive project management, business analysis, test management, and program oversight services to guide their insurance brokerage through the Operational Resilience “Transition Period.” We help you:

Assess your status against the Operational Resilence FCA obligations

Implement robust Operational Resilience (OR) policies and governance structures.

Identify and map your Important Business Services (IBS) for end-to-end resilience.

Design and execute effective testing strategies to ensure your IBS remains resilient and is maintainable within your day to day operations.

Benefits:

Compliance: Comprehensive audit ensures adherence to all legal obligations.

Risk-based prioritisation: Focuses efforts on areas with the highest impact.

Operational efficiency: Streamlined processes and improved controls.

Cohesive Operating Model: Holistic approach for better overall performance.

Industry recognition: Achieved top accreditation for data privacy practices.

Let our experts help you navigate Operational Resilience complexities and achieve operational excellence.

Operational Resilience

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.